Success Story

Redeveloping an omnichannel Point of Sale (PoS) application for an Indian unicorn

Services Used:

The client is a leading merchant services platform that became India’s first unicorn for the year 2020. The firm is focused on accelerating commercial activity for merchants in each local market. They provide merchants with payment solutions, risk assessment, integrated billing services, reward plans, and much more. The firm is constantly innovating to come up with robust solutions to simplify digital payments for merchants and customers alike.

- $3.5B valuation

- >100,000 merchants onboard

- $2.5B TPV per annum

Business Situation

The merchant-customer relationship is always a high-priority aspect for any PoS solutions provider. Cost-effective, time-efficient payment solutions can ensure that this relationship grows stronger and presents opportunities for quick ROI as well.

In the efforts to better its unified cloud-based payment platform, the client approached Daffodil Software for modernizing its existing payment platform. The legacy application did not have up-to-date capabilities for offline transaction record-keeping, and for sorting and looking up records efficiently. Additionally, there was a lack of clear bifurcation between different bank schemes and the scheme approval flow was not well defined.

Following a series of brain-storming sessions with the client, Daffodil was presented with some of the below-mentioned requirements for modernizing the payment platform:

- Come up with a simple infrastructure for auditing and syncing online and offline transaction history

- Provision for proper and detailed grouping of bank schemes and their mapping

- Maintain proper bifurcation between transaction servicing and transaction reconciliation

- Implement reliable sorting and searching features with state-of-the-art database integration

The Solution

The inception stage of development had been challenging for team Daffodil as it required auditing and optimizing the existing codebase for modernizing the entire app. As a result, a number of UX updates and performance fixes were done in the existing version of the app. Comprehensive consultations with the client’s teams led to a precise translation of their business needs. This was done so that the Daffodil team could come up with an innovative and robust flow for bank scheme creation and approval on the modernized payment application.

Some of the major revamp in the application were the following:

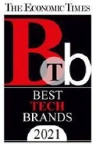

Transaction Reconciliation: Apache Kafka was leveraged for the end-of-day reconciliation of offline and online transaction reports on the payment application. With Kafka, transaction flow is not broken, even if there are refunds and other transaction settlements throughout the flow. Therefore, the transactions, including the ones that are made offline, could be synced seamlessly at the end of the day.

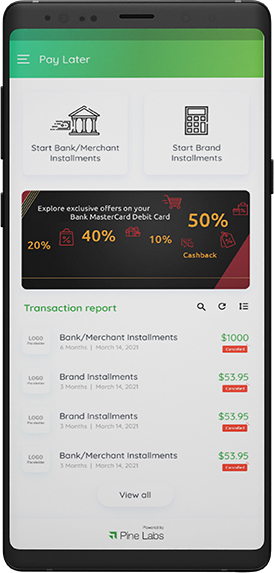

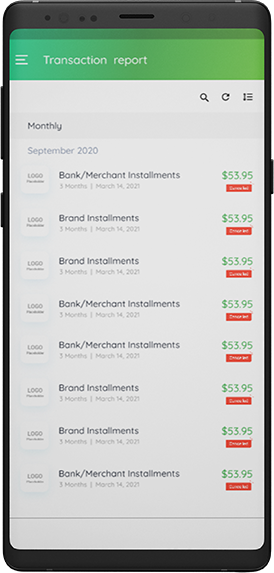

Better Scheme Management: The API flow of the bank schemes’ creation and approval was divided into multiple queues for better management. The payment schemes could now be grouped according to their category – for instance, grouping based on interest-bearing (merchant, consumer, or brand interest-bearing). The validity of the schemes was continually updated by mapping it to the transaction amount, the card used, and the date of scheme creation.

Direct Querying: The existing solution did not have direct querying functions as it used MongoDB as its querying database. After intensive R&D by the team, PostgreSQL was chosen as the new database. This helped for the inclusion of efficient transaction sorting and searching functions through direct querying.

User Journey Tracking: The ELK (Elasticsearch, Logstash & Kibana) stack was implemented for tracking the user journey. This helped resolve the issue of convoluted usage logs. The user journey-based microservice logs could now be tracked in an uncluttered manner.

The Impact

The client’s payment platform was enhanced in terms of its capabilities for seamless syncing of online and offline transactions. User journey management and tracking have become foolproof due to new innovations in creating usage logs. There are multiple payment gateway solutions to choose from for online transactions. Additionally, the downtime related to breakage in transaction flow has been eliminated. The solution, innovated upon by the Daffodil team, has been highly appreciated by the client for the sheer ease of management that it provides.

- $3.5B valuation

- >100,000 merchants onboard

- $2.5B TPV per annum

“Now we’ll be able to offer merchants a solution that has integrated all kinds of payment solutions in the market. We had been running on stealth mode processing payments worth $150-$200 million monthly with over 250 merchant partners including Chroma, Cred, and Reliance Digital,”

CEO – During an interview with the Economic Times

Read Related Case Studies

Get in Touch

Sign up for a 30 min no-obligation strategic session with us

Let us understand your business objectives, set up initial milestones, and plan your software project.

At the end of this 30 min session, walk out with:

- Validation of your project idea/ scope of your project

- Actionable insights on which technology would suit your requirements

- Industry specific best practices that can be applied to your project

- Implementation and engagement plan of action

- Ballpark estimate and time-frame for development